2024 Spring Supplemental Operating Budget Adjustment

Each year in the Spring and Fall, City Council discusses and debates a supplemental budget adjustment. During this process, we review the 4-year Budget which was approved for 2023-2026, and make adjustments to accommodate changes that happen as priorities shift, new issues and challenges emerge, and funding opportunities are made available or are reduced. This is usually not a substantive change, but we are still in unprecedented times, and are now experiencing an unprecedented increase.

Council has unanimously approved a property tax increase of 8.9% during this week’s operating budget adjustment, which I recognize to many is a substantial change, up 2.3% from what was discussed in the fall. Many households and businesses are grappling with inflation of our daily goods and services, rising utility costs, and more. I acknowledge the gravity of this decision and the impact it will have on each of you. Just like households, the City is also experiencing cost pressures, from inflation impacting base costs to deliver the same programs and services, to rising utility costs to keeping the lights on in our libraries, rec centers, and municipal buildings. Not to mention a substantive amount of population growth in the City, with a rate higher than we are seeing in Alberta and across Canada.

So how did we get here? In this blog I want to answer this question, but also some of the common questions that I hear a lot from residents in the community, and in general public sentiment.

What are the pressures that resulted in a 8.9% tax increase?

After years of low tax increases (the average property tax increase over the last decade is 3.3%, and over the last 5 years is 2.1% - with some of the lowest increases in decades), we are now in a period where this is no longer sustainable with high prices, inflation, increasingly complex social challenges, and rapid population growth. This tax increase is needed to maintain the level of services that we have and offer for a growing city.

For this budget adjustment, utility rates and WCB premiums are higher than what we originally forecasted - we make our best estimates during the budget cycle but we have seen costs increase much faster and higher than forecasted.

We are also seeing impacts from labour settlements and negotiations, which are challenging and come with numerous considerations. This comes after years of economic uncertainty during the pandemic, which resulted in many workers not seeing wage increases. In fact, some unions voluntarily paused increases that were negotiated to support Edmontonians during the pandemic. This is why I supported the final settlement for CSU 52, and the tax implications that came with it - it is a fair deal. During the negotiations, we heard loud and clear from Edmontonians that they did not want to see services disrupted because they rely heavily on things like rec centres, libraries, licensing and permitting. And I agree, and think it is critical to protect the integrity of our public services.

We have seen a significant decrease in Provincial funding over the years - this includes a steep decline in infrastructure dollars to municipalities. Right now Alberta Municipalities estimates a $30 billion dollar infrastructure deficit across the province, with funding to municipal governments reducing by 64% from 2011 to today - this is a decrease of $454/Albertan in 2011 to $154/Albertan today. This creates a large financial burden, which cities are required to make up (in this case with property taxes).

In addition, there are other costs incurred by Edmonton which specifically fall under Provincial jurisdiction but are left for the City to pick up. The City spent $2.2. Million in the last few years to support the Shigella response by AHS, and we anticipate another $1.2 million a year on an ongoing basis. This should fall under health spending - AHS declines to step up. Similarly, we have calculated that the City has spent $9.1 million on our opioid response (for example, our fire rescue responding to EMS calls for overdoses). You can read a recent letter from Mayor Sohi which outlines the provincial cuts AND downloading of responsibilities that the City has seen.

But how did we go from 8.7% to 8.9% during this budget adjustment? A few colleagues added additional spending for Event Attraction ($2 million to attract sporting and cultural events for an economic return of $300+ million) and Enhanced Downtown Cleaning ($1.5 million through redirected funding) - I did not vote to support either item. The only thing I did support was sidewalk snow removal for seniors and people with disabilities, for a minimal investment that will address a long-standing need heard from a highly vulnerable segment of our community. No one is arguing about the value of a service or program - they are all valuable and important for a growing city. My perspective was that I didn’t think we needed all of them right NOW, in the face of all the cost pressures experienced. Ultimately, this wasn’t an easy budget to support, but it would be irresponsible to not also recognize that there are consequences for voting no against a budget adjustment - you can listen to my closing thoughts on this in Chamber below.

Are there systemic or structural issues with city budgeting?

I want to start off by addressing that the City of Edmonton is in a stable financial position, despite what some of the unhelpful rhetoric has been out there. We have strong financial policies, a well-defined budget, a high credit rating (rated by external third parties), and financial reporting which is transparent, and is also externally audited. In order to keep this solid position, we now need to make decisions about how to deal with the cost pressures we are experiencing.

If we continuously keep our taxes lower than proposed, we will not be making a financially prudent decision and it will eventually lead to instability. Why? First, pushing off projects for later, like many have suggested, makes things more expensive in the long run. We are a growing City, the projects on our docket need to happen so that we can continue to provide programs and services for a larger population. Not proceeding means future Councils and Edmontonians will ultimately face a reckoning (like this Council did with the Lewis Farms Rec Centre Project, a promise made years ago which got pushed and pushed, and this Council finally funded with a much higher price tag).

Second, years of underfunding public services, a result of chronic below inflation tax increases got us to this place. During the pandemic, these zero, or close-to-zero tax increases were what Edmontonians needed to get by. Now, ultimately to stop the cycle of high tax increases indefinitely, we need to fund our City services like snow removal and transit adequately, we need to replenish our Financial Stabilization Reserve which we utilized to cover deficits during times of low tax policies, and we need to find other ways to meet the demand of the significant growth we are seeing (akin to adding the entire population of Red Deer to Edmonton every two years) as the property tax base is not a sustainable funding source.

During the Spring Operating Budget Adjustment, we also talked about our budgeting processes, and passed motions to explore different ways of addressing the budget. This includes an action plan to respond to structural budget issues and growth challenges, and analyzing our capital spending to reduce impacts on the tax levy. This work will come, and I am hopeful that it will provide more clarity and certainty to the process of budgeting.

I also recommend reading this recent op-ed from my colleague Councillor Erin Rutherford on “Good financial stewardship is more than keeping taxes low”.

Does the City Council look for savings? Don’t you review the budget each year?

Yes, when we set the budget we review each service line by line - this is our role as governors of the City. While this is not always typical for budget adjustment, in the last few years, we have also undertaken long discussions and debates for these reviews, where we scrutinize each individual cost. We go in-depth on service delivery, ask questions about programs and if they are producing the results we want to achieve, based on the needs of Edmontonians and the City.

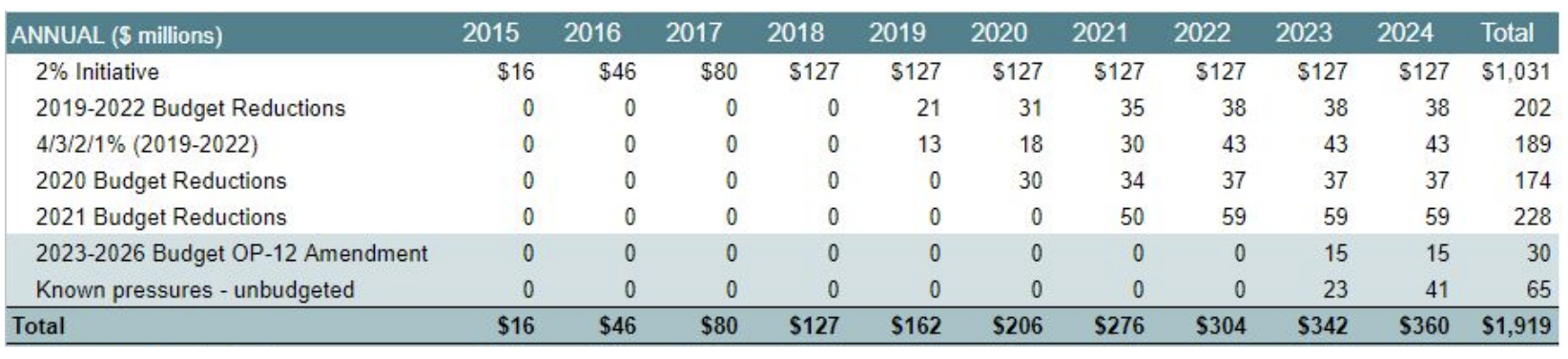

Administration has gone through a series of intense budget reductions and efficiency exercises over the last decade (as seen in the graph above) - in total this has resulted in savings of 1.9 billion dollars, preventing tax increases by 21.5% since 2015. Each year, we review, we assess, and we challenge where efficiencies can be made. This is not something that is done as a one-off, but is now built into our continuous quality improvement.

Over the last budget cycle, the Administration has also been engaging in an exercise called OP-12, to reduce the City’s operating costs by $15 million a year for 4 years, and reallocating $240 million dollars towards frontline services. This exercise resulted in numerous ideas to reduce costs, or generate greater revenues by the City. For example, in March, we approved another $8.2 million in savings from the OP-12 exercise which will go to the Financial Stabilization Reserve. The ideas generated through OP-12 will continue to be implemented to help create efficiencies and continual improvements. All this to say - if there are dollars to be found and saved, we have found them, and now it is time to put the plan into action to realize the savings.

A common question I hear is about reducing what is perceived as a ‘bloated’ middle management for cost savings. This tends to be the easy scapegoat. In fact, since the City’s proactive audit on Management Staffing in 2020, City Administration has been right-sizing the number of frontline employees to supervisory leaders, trending towards more frontline staff per supervisor (a 5.5% decrease since 2020). This has resulted in the City of Edmonton having a leaner middle management to frontline ratios (~13%) compared to major cities like Calgary (18%). Can we be more efficient with staff time and reduce layers of bureaucracy? Absolutely. That is why I have continued to challenge Administration to empower frontline workers and continue to right-size the management ratio. As have my colleagues like Councillor Knack and Councillor Cartmell through their questioning and motions in the past.

Can we budget better? Have things drastically changed from 6 months ago?

As I mentioned, at the City, we do our best to budget and forecast expenses and revenues with the information available to us. But the cost of delivering the same services, and moving forward on projects has risen faster and quicker than anticipated. If you look at gas prices today, versus 6 months ago - you can see these cost escalations in real time. Things can change in 6 months.

The City also budgets for things that are within our core mandate and jurisdiction - transit, for example, or neighbourhood renewal. We make sure key services get the funding they need. What we cannot budget for is unforeseen situations that occur outside of our realm of control - for example, the Shigella response requested by AHS, or our wildfire response when other cities and territories are in need and Edmonton is asked to step up. We have seen more of these as of late, and the responsibilities along with the bill, are being downloaded on municipalities and the property tax base.

Cities do not operate in a silo - we interact with other policies, regulations and partners across Government. Most recently, we heard about Bill 18/Provincial Priorities Act being introduced by the Government of Alberta which would lead to cities (and other provincial entities like post-secondary institutions and health authorities) needing Provincial approval to receive funding dollars from the Federal government. While we are still learning how this could impact municipalities, creating uncertainty in our ability to receive federal funding also impacts our budgeting, and how we plan for housing and infrastructure. This makes things all that more difficult because it impacts not only our ability to get this funding, but also the timeliness by which your federal tax dollars can be deployed and invested back into the community.

Why can’t you cancel projects like the Bike Lanes or the LRT so that taxes do not have to go up?

I have heard from community members who propose cutting, for example, the Bike Network as a potential solution for decreasing the property tax levy. However, that funding is not transferable. The Bike Network funding is capital funding on debt which unfortunately, is not operational funding (which impacts the tax levy). And, as I mentioned, stopping capital projects that are beyond a certain point also has financial, reputational, and partnership risks. All this to say, canceling capital projects that are important for the future of our city does not have the same impact on the tax levy.

In challenging times, Edmontonians rely on City services more than ever to get to work or school, to make sure businesses can open their doors, and so that people can continue to have a good quality of life. We are now a city of well over 1 million people, from incredibly diverse backgrounds and experiences. What’s important for one person isn’t necessarily the same as their neighbour - so the project that you might see as ‘overspending’ is something that is ‘essential’ to someone else. In this role, I focus on the public good, and what is best for the community, which includes people of different backgrounds, income brackets, genders, and life experiences. I see our role as governors as reflecting on the diversity of perspectives and developing policies that best meet the greatest good and build a thriving city.

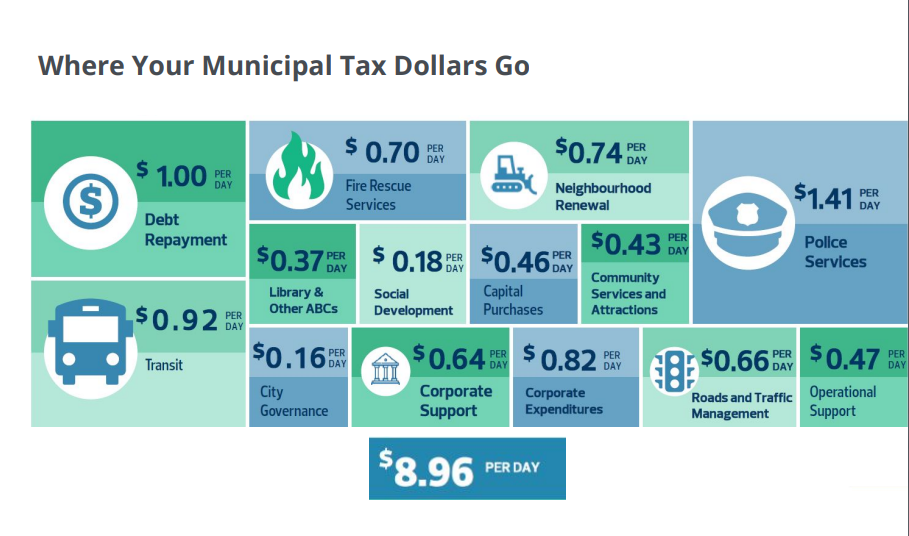

Reducing services in our operating budget is what will lead to the biggest impact on property taxes. I hear from many about which City services are the most critical and important to them. Balancing these different voices, different lived experiences, and different ways people use and interact with our city services is challenging. If you have thoughts on which of the 70 lines of services you would be comfortable with reducing - for example, transit, policing, fire rescue, library, neighbourhood renewal, or others, I’m interested in your thoughts and your rationale.

I hope that this blog helps shed more light on this budget adjustment, and answers some of your burning questions - I appreciate you taking the time to read it. I understand that you may still have questions about this decision and its implications. I remain committed to transparency and continuing to advocate for the needs of our community while striving to find sustainable solutions for our City and within budgetary constraints. Do not hesitate to continue to share your questions and ideas with me and my team at keren.tang@edmonton.ca.

We are onto a period of course-correcting - it will be difficult and it will take time. But without course-correcting, and adjusting for the systemic and structural ruptures in municipal finances, we won’t ever be able to achieve our service standards, our City Plan goals, and be ready to accommodate additional growth as we move towards a city of 2 million. It is important that we all work together, now more than ever, to come up with solutions to support the growing City we call home.